The Belt & Road Initiative (BRI) EMBA Program at the PBC School of Finance (PBCSF) of Tsinghua University held its first offline/online hybrid-learning module in Shanghai from October 22 to 25. Students from various cohorts returned to classrooms this week for the first time since Covid-19 began. This module featured a field visit to NIO and lectures from distinguished scholars and experts, including Professors Jian Wang, Jiandong Ju, Yi Huang, and Xiqing Gao.

With the ongoing Covid-19 pandemic, countries have implemented travel restrictions to limit the spread of the virus. As a result, EMBA education has changed dramatically, especially since almost 70% of the students enrolled in the BRI EMBA Program are based overseas. After months of remote learning and online class meetings, this was the first time that the BRI EMBA Program organized a module with face-to-face component. About 30 students met in the Tsinghua PBCSF’s Shanghai Center, while 50 others tuned in virtually.

Before the lecture portion of the module, the students in Shanghai were invited to NIO, a Shanghai-based electric vehicle (EV) producer serving the premium market in China.

Bin Li, the founder of NIO, delivered a presentation on the company’s strategy and vision as well as the outlook for the EV industry.

Students of the BRI EMBA Program at Nio

Bin defines the company as a user enterprise that endeavors to promote customer experience. Having a precise customer portrait, NIO clearly positions itself as a competitor to Audi, BMW and Mercedes-Benz. In the future, Bin said that there will likely be two rounds of industry shuffle in 2025-26 and 2030-2035 as traditional car companies expand into the EV arena and software upgrade.

Professor Jian Wang, Assistant Dean (Academic) at the School of Management and Economics of the Chinese University of Hong Kong (CUHK), delivered a lecture on China’s economic growth and opportunities in the Guangdong-Hong Kong-Macao Greater Bay Area (GBA) to the students.

He pointed out that China’s economic growth miracle from 1978 to 2007 was both a political transformation shifting from ideological contention to economic development and a socio-economic reform transitioning from central planning to market-based economy. Resource allocation went from the unproductive SOEs to the more productive private businesses, which helped sustain productivity growth.

Prof. Jian Wang

With a strong government ensuring social stability and the pragmatic strategy of “crossing the river by feeling the stones”, China specialized in the industries of comparative advantage, and became an important part of the global supply chain through trade and FDIs. These factors are important ingredients to China’s growth miracle, according to Prof. Wang.

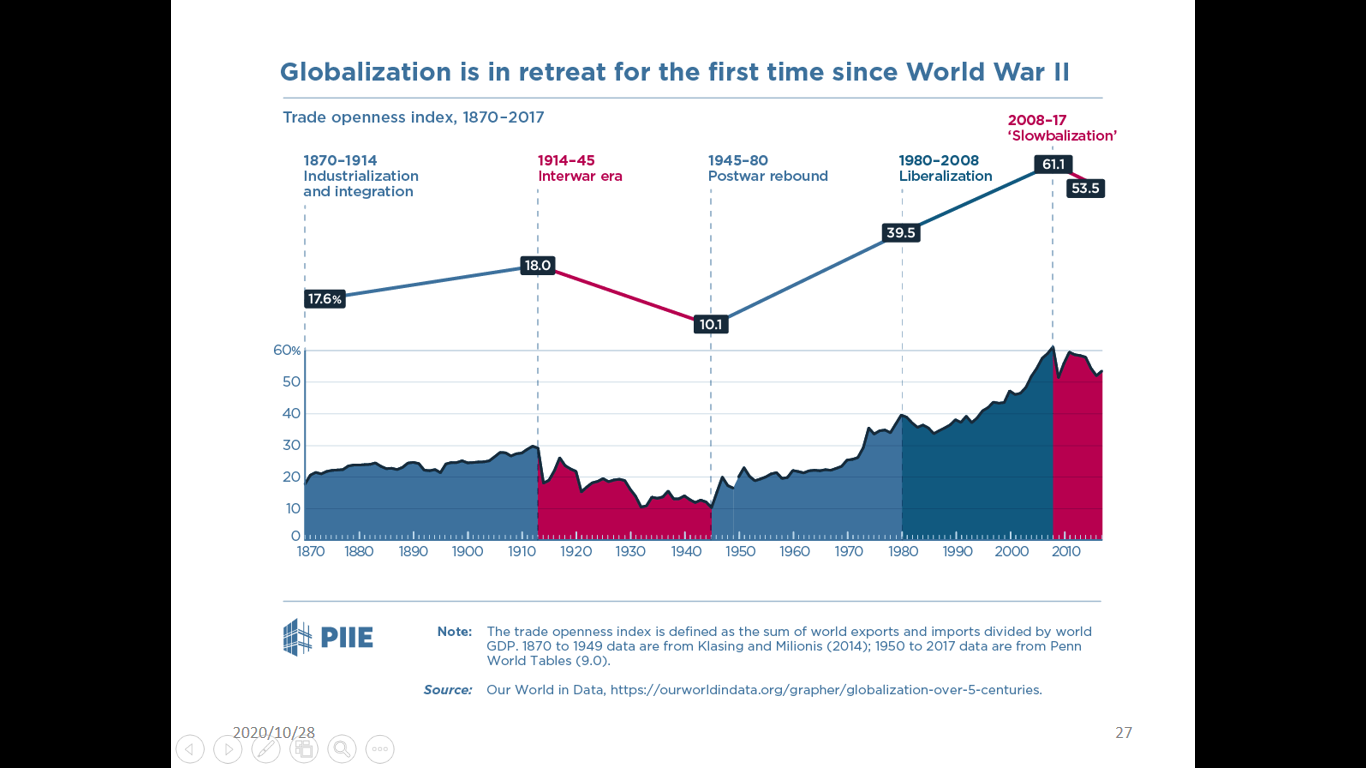

De-globalization further suppresses global economic growth

Prof. Wang also compared the views of Justin Yifu Lin and Robert Barro with respect to China’s growth potential, which in conclusion, remains around 7% today, despite internal challenges such as resource misallocations, aging population, environmental pollution and external challenges such as tense relation with the US and slow global economic growth.

Drawing comparisons between the Greater Bay Area (GBA) to the other three bay areas of the world, namely the ones in New York, Tokyo, and San Francisco, Prof. Wang indicated that the GBA is more diversified, with Hong Kong specializing in finance, Guangzhou in advanced manufacturing, and Shenzhen in high tech innovation. The special political status of Hong Kong and Macau, besides Hong Kong’s position as a global financial center and the bottom-up approach of the area as a whole, are all advantages of the GBA.

On opportunities in the GBA, Prof. Wang identified scientific research and financial markets as two areas of potential cooperation between Shenzhen and Hong Kong. As the quality of R&D still has room for improvement, cooperation in university-enterprise research, rules and practice of IP protection, as well as professional services all present great potential.

Professor Jiandong Ju, Unigroup Chair Professor at PBC School of Finance in Tsinghua University, shared his latest research and insights on U.S.-China Trade Disputes and the New World Order.

Prof. Jiandong Ju

In the past two years, Prof. Ju has been striving to reconstruct the theory of international trade disputes outside the framework of neoclassical economics. "For us, the issue of international trade disputes and world order cannot be avoided. We need to have theories to study it." He said.

At present, there is much discussion in Europe and the United States on the global economic disorder and chaos caused by the severe economic conflict between China and the United States, and it seems that countries must "take sides." It is under the influence of this "either/or" mode of thinking that the United States has adopted a set of "de-Sinicization" strategy, attempting to ostracize China out of the international economic and trade systems in order to maintain its leading position.

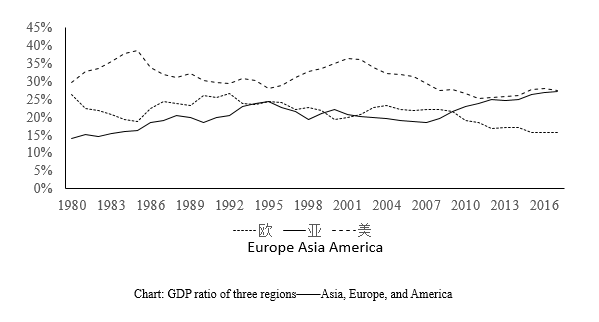

According to Prof. Ju, such talk of a "power grab" is misleading. The current problems facing the global economy stem from the contradiction between the foundations of the global economy and the superstructure. In the past 20 years, global value chains (GVCS) have formed three pillars, with the United States, China and Germany becoming the core countries in the Americas, Asia and Europe respectively.

The global economic landscape dominated by three core regions

However, transformation of the global superstructure is lagging. Both the global monetary system and the economic and trade system are still dominated by the United States. "The chaos of today's world is caused by the mismatch between the tripartite economic base and the global economic governance system dominated by the US and the US dollar," Prof. Ju said, "We do not want to compete with the US for global leadership and we do not believe that any one country can dominate the global economic and trade order. All China has to do is to adapt the global superstructure to changes in the economic base."

Prof. Ju argued that the new global order should also be a three-pronged governance system, with the United States representing North America, Germany and France representing Europe, and China representing Asia. He said that the regional governance system in Asia has been absent for a long time, and the existing regional economic governance model in Asia is not in harmony with the regional economic structure. At the same time, Covid-19 has created an important "window period" for China to promote the establishment of a shared Asian community.

The reasons are that first, the US has too much on its own plate to intervene in Asian affairs, and second, Asian countries urgently need cooperation to cope with the unprecedented challenges posed by the pandemic. China can take this opportunity to advance the building of a shared Asian health and economic community through unilateral opening up, bilateral negotiations, and orderly entry.

Professor Xiqing Gao, Hongtian Professor of Law at the University of International Business and Economics (UIBE) and former President and Chief Investment Officer of China Investment Corporation, lectured on the history of China’s capital market and discussed about the legal issues in cross-border M&A.

As Prof. Gao introduced, the development of China's capital market had gone through the stages of quota management, managing the number of institutions, and the channel system (managing the offering price and PE ratio). When the reform started in the 1980s, the banking system consisted of the Ministry of Finance, the People’s Bank of China, and the four large state-owned commercial banks, and the securities market had only one product — national construction bonds, with no trading markets in place. Near the end of the 1980s, joint-stock commercial banks, urban credit cooperatives, rural credit cooperatives, and private banks arose. By the 1990s, urban commercial banks and rural commercial banks developed.

Prof. Xiqing Gao

“The development of the market always follows the process of “innovation -- regulation -- further innovation,” Prof. Gao said. Innovation is not possible without regulation, and regulation that hinders innovation is similar to avoiding eating because of the fear of choking. Prof. Gao compared different regulation models, and expressed that the most important things remain the improvement of public governance and the promotion of the rule of law.

In the 40th collective study of the Central Politburo of the Communist Party of China on the topic of safeguarding national financial security, he stated that it is imperative to enhance financial regulation and to ensure that regulatory authorities could focus on the key links so as to efficiently prevent and control risks. Financial development and regulation shall form a powerful synergy and the shortage of regulatory rules shall be covered, to avoid regulatory gaps. The Report of the 19th CPC National Congress also reiterated that China will let the market play a decisive role in resource allocation.

Professor Yi Huang, Pictet Chair in Finance and Development at the Graduate Institute in Geneva and a research affiliate at the Center for Economic and Policy Research (CEPR), talked to the students about the world economy in the era of pandemics.

Prof. Yi Huang

Prof. Huang shared his views on the global economic outlook after the pandemic. “When will the pandemic end? Viruses and vaccines have the final say,” he said. As a result of the epidemic, economic growth in the entire Asia-Pacific region will be slow, while the economies of most countries in Europe and the United States, which are clients of China, will be weak. However, global competition in value chains will not be affected by Covid-19, Prof. Huang argued. Instead, the pandemic will accelerate the transformation of globalization, especially the replacement of old with new elements. The traditional manufacturing industry is in decline, while new information technology, digital economy, information network and service industries are rapidly advancing. This is a global trend.

First launched in 2017, the BRI EMBA Program adopts an educational approach that is closely aligned with the demands of China’s Belt and Road Initiative. One of the most sought-after EMBA programs in the Asia-Pacific region, the BRI EMBA Program brings together domestic and world-renowned professors, scholars, and outstanding leaders in various fields of the financial industry for the cultivation of industry-leading talents and innovators with international vision and pioneering spirits.

The Program has so far attracted more than 180 high-level enterprise decision-makers from 22 countries and regions, including Singapore, Indonesia, Malaysia, Thailand, the United States, Canada, Kyrgyzstan, Kazakhstan. A number of students from Southeast Asian Countries hold Tan Sri, Dato' Sri, Dato’, Tengku and other honorary titles. Nearly 40% of the students graduated from world-renowned universities such as MIT, Stanford, Harvard, Yale, Cornell, Oxford, Cambridge and Imperial College London.