Building on a wealth of educational and industrial resources, BRI EMBA program aims to help Chinese and Southeast Asian entrepreneurs acquire an in-depth understanding of China and Asian economies, and explore new opportunities under the Belt and Road Initiative together.

How You Are Going To Learn

|

Program Duration 2-3 years 1 module every 2 months 4-5 days per module |

Teaching Language English and occasionally Mandarin Chinese (Simultaneous interpretation available for all courses.) |

Delivery Location Alternating between major Chinese cities (Beijing, Shanghai, Shenzhen, etc.) and Southeastern metropolises (Singapore, Kuala Lumpur, Jakarta, Bangkok, etc.), depending on specific requirements of each module |

|

Total Credit Units

32.0

|

Compulsory Company Visits

In each 5-day module,4 days are spent on in-class lectures,while 1 day is for company visits.

|

Who You Are Going to Study With

Students hail from 20+ countries and regions.

CHINA 27%

- CHINA27%

- SINGAPORE17%

- MALAYSIA15%

- INDONESIA13%

- HONG KONG

- CANADA

- AUSTRALIA

- TAIWAN

- USA

- THAILAND

- VIETNAM

- UNITED KINGDOM

- JAPAN

- KOREA

- KYRGYZSTAN

- KAZAKHSTAN

- MACAU

- NORWAY

- TURKEY

- ANTIGUA & BARBUDA

- NEW ZEALAND

- SWITZERLAND

- GERMANY

-

29%

of the students are from leading Chinese companies, such as Alibaba, Baidu, Ant Financial, China Overseas Holding Group, Jiangsu Nantong Sanjian Construction Group, etc.

-

40%

of the students are alumni of world-renowned universities: MIT, Stanford University, Harvard University, Yale University, National University of Singapore, etc.

-

84%

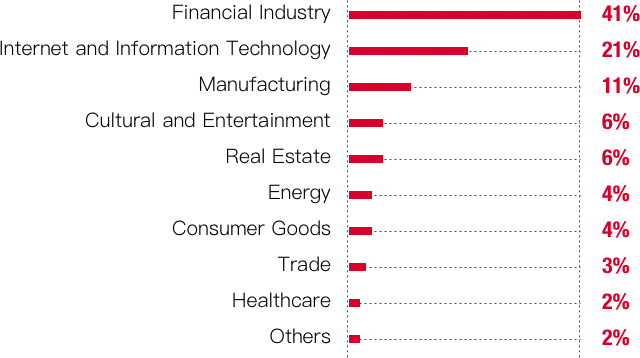

84% of the students are top decision makers within leading enterprises,1/3 of which are listed public companies and 10 are unicorn companies. These companies cover a wide range of industries, including financial investment, Internet and information technology, manufacturing, etc.

What You Are Going To Study

Created for entrepreneurs and senior executives from all academic backgrounds, BRI EMBA Program starts by building a thorough foundation in the study of finance. Through cross-regional class modules and company visits, students will gain an in-depth perspective on Asian economies and China’s ‘Belt and Road’ Initiative, given its important role in the infrastructure development and beyond of the entire Asia region, learn how to effectively apply advanced financial theories, work with capital markets and financial institutions, and engage in business deals with Chinese entrepreneurs.

Learning about China |

Global Finance Markets |

Corporate Finance |

Leadership, Management and Personal Development |

Internationalization and Overseas Investment |

Technological Innovation/Industrial Revolution |

|---|---|---|---|---|---|

| The Chinese Economic Reform and Developmen | Global Capital Market |

Corporate Finance |

Intercultural Communication in Global Business Settings under the Framework of BRI |

New Normal of Global Trade |

New Trend of AI Development |

China's Macro Economy and Financial System |

Value Investment Theory and Practice |

Tax Planning and Cross-border Transactions |

Corporate Strategy |

China Outbound Investing |

Fintech |

Deployment of Belt & Road Initiative |

Private Equity and Venture Capital |

Performance Evaluation and Motivation |

Negotiating Globally |

Foreign Exchange Policy |

Technology Innovation and Investment |

China Capital Market |

Asset Management |

Behavioral Finance | Cross-Cultural Communication |

Sustainable development |

|

Asset Securitization |

-

Cross-Regional Class Modules

Kuala Lumpur·Malaysia

Beijing·China

Singapore

Jakarta·Indonesia

Bangkok·Thailand

Hong Kong·China

Shenzhen China… -

Visit Local leading companies

and financial institutionsChina Life Insurance, Industrial

and Commercial Bank of China,

CFLD, China Development

Bank

CIMB, YLT Group, Government

of Singapore Investment Corp

(GIC), Singapore Exchange

Who Your Instructors Are Going To Be

The faculties and guest lecturers in this program are either renowned professors from the PBC School of Finance and/or Tsinghua University, famed scholars from other universities around the globe, high ranking governmental officials, or senior executives from leading financial institutions. Policy makers from financial regulatory authorities are also frequently invited to teach.

-

21

full-time faculty members

-

15

special-term profess

-

149

industry supervisors and adjunct professors