From October 15–19, 2025, the Tsinghua PBC School of Finance (PBCSF) Belt and Road Initiative (BRI) EMBA Program successfully conducted its Almaty course module. This module brought together distinguished figures from government, business, and academia, integrating advanced lectures, institutional visits, and internal sharing sessions. Together, these components offered students a panoramic platform for understanding Central Asian markets and seizing emerging opportunities in cross-border cooperation. Through dynamic intellectual exchanges and resource integration, students gained a profound understanding of Almaty’s role as a financial and industrial hub in Central Asia, injecting new momentum into cross-border investment and industrial collaboration under the Belt and Road framework.

Group photo of students in the BRI EMBA Almaty Module

Faculty Matrix:

A Convergence of Academic Insight and Industry Leadership

The module convened world-renowned scholars and practitioners deeply engaged in Central Asian markets. From macroeconomic perspectives to sectoral applications, the program delivered a multidimensional knowledge experience.

Macroeconomics and Geopolitical Perspectives

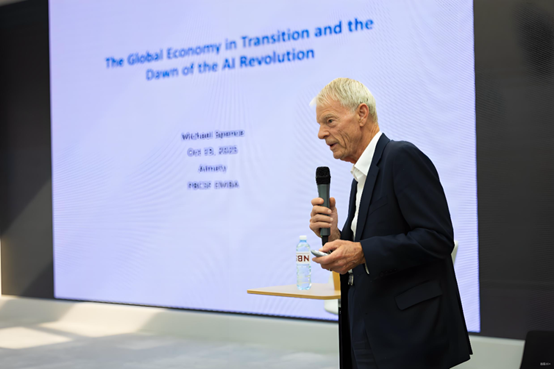

Nobel Laureate in Economics Michael Spence delivered a keynote lecture on “The Global Economy and the AI Revolution.” Drawing on his extensive research into structural shifts in the global economy, he emphasized that artificial intelligence, as a “super-general-purpose technology,” is emerging as a critical solution to long-term challenges such as the global slowdown in productivity growth.

In particular, he analyzed how AI is shaping the development of the digital economy in Central Asia. Rather than generating short-term bursts of impact, he argued, AI would gradually drive industrial upgrading—first through adaptable sectors such as financial technology, and progressively extending to supply chain management, intelligent transport, and other real-economy applications. He noted that by strengthening human–machine collaboration, AI could foster differentiated competitive advantages across the region. However, he also cautioned that to fully unlock this potential, governments must promote equitable access, effective policy guidance, and skills development—ensuring that AI adoption becomes a sustainable engine for growth.

Photo: Michael Spence

John Anthony Quelch, President and Executive Vice Chancellor of Duke Kunshan University, led a dialogue on “Geopolitics and China–U.S. Relations.” He observed that China’s transition from a “world factory” to a knowledge-based economy has progressed far faster than anticipated by the United States—disrupting traditional expectations and prompting responses such as tariffs and export controls. China, in contrast, has responded with composure, emphasizing an equitable environment for foreign investment and the continued expansion of its firms into global markets.

Quelch noted that artificial intelligence has become the core arena of strategic competition between the two countries. The U.S. has adjusted research funding policies and tightened visa regulations, reshaping patterns of global talent mobility, while Chinese universities are increasingly attracting international students. He argued that the key to improving China–U.S. relations lies in rational, historically informed dialogue: as two economies that together account for 43% of global GDP, China and the U.S. bear a shared responsibility to engage constructively. He concluded that while companies can adapt through flexibility and innovation, high-level summits between national leaders remain essential to resolving deep-seated differences.

Photo: John Anthony Quelch in dialogue with BRI EMBA alumnus Yanan Wu

Industry Practice and Investment Strategy

Tsinghua PBCSF Industry Mentor and veteran Wall Street investor Yang Qinghong delivered a lecture on “Investment Theory and Practice—Value Investing.” The course consisted of two major modules: Fundamental Investing and Technology Investing, with the Almaty session focusing primarily on the fundamentals.

Yang began by introducing the basics of equity investment before systematically unpacking valuation methodologies in practice. On intrinsic value, he analyzed asset-based, earnings-based, and growth-based approaches, covering asset valuation models, profitability value models, and growth estimation frameworks. He then explained relative valuation metrics such as P/E and PEG ratios.

Yang also explored how to capture dynamic market opportunities—identifying breakout and reversion cycles, analyzing bubble characteristics, and examining behavioral patterns of the new wave of retail investors. Using real-world examples, he demonstrated how to profit amid extreme market sentiment.

Throughout the session, Yang integrated multiple case studies—including GPS chip companies, 3D printing, IPTV chip enterprises, GME, AMC, and oil price fluctuations—supported by charts comparing data costs, NASDAQ index trends, and market valuation indicators. These examples helped students build a comprehensive understanding of the combined logic of “static valuation and dynamic inflection,” forming a robust framework for long-term investment analysis.

Photo: Yang Qinghong during the lecture

Kairat Kelimbetov, former Deputy Prime Minister and Governor of the National Bank of Kazakhstan, and chief architect of the Astana International Financial Centre (AIFC), delivered a keynote on “Kazakhstan’s Economic Diversification, the AIFC/AIX Financial Hub, and AI-Driven Connectivity.”

He provided an in-depth overview of Kazakhstan’s transformation from a Soviet planned economy to an open market economy over the past three decades. As a “super-connector” linking Asia, Europe, and the Middle East, Kazakhstan has leveraged cross-border corridors and the Belt and Road Initiative to overcome geographic constraints. With over 4,500 enterprises registered under the AIFC framework, foreign investment exceeding US$350 billion, and a national GDP of approximately US$300 billion, Kazakhstan has emerged as a financial and logistical hub for the region.

Kelimbetov detailed the country’s strategies for industrial diversification—strengthening traditional resource sectors while cultivating new growth engines through cluster development, digital transformation, and an AI-driven “ABCD” innovation system. He emphasized Kazakhstan’s achievement of a 90% cashless economy within three years as a foundation for sustained modernization. Finally, he outlined practical avenues for deepening international cooperation—leveraging AIFC/AIX platforms, expanding AI applications, and advancing pragmatic collaboration under the Belt and Road framework.

Photo: Kairat Kelimbetov addressing students

Professors Maxat Kabashev and Maxim Kiselev from Narxoz Business School joined for academic exchanges. Kabashev spoke on “System Dynamics and the Real Estate Market”, combining theoretical models with empirical analysis to reveal core drivers of real estate cycles. Kiselev discussed “The Transformation of Leadership: East Meets West”, exploring how leadership evolves across cultural contexts, offering insights that blend global vision with local relevance.

Government and Enterprise Visits:

Engaging the Pulse of Central Asia’s Real Economy

A series of carefully curated site visits allowed students to engage directly with Almaty’s business ecosystem and investment landscape.

Finance and Capital Markets

Representatives from Kazakh Invest, Almaty City Department of Entrepreneurship and Investments, AIFC, and the National Chamber of Entrepreneurs of Kazakhstan (Atameken) met with students for in-depth discussions on macroeconomic conditions, regional potential, and financial innovation.

Kazakh Invest opened the session with a presentation titled “Why Invest in Kazakhstan,” highlighting the country’s strategic role as the largest economy in Central Asia. With its 2.7 million square kilometers of territory connecting Eurasian transport corridors, abundant mineral and renewable resources, and stable macroeconomic fundamentals, Kazakhstan offers a favorable investment climate reinforced by tax incentives on land and corporate income.

The Almaty Department of Entrepreneurship and Investments presented Almaty’s distinctive advantages as the nation’s commercial capital—accounting for 23% of Kazakhstan’s GDP, attracting US$6 billion in FDI, and offering visa-free access to 85 countries and 52 direct international flight routes. Its industrial and technology parks have already attracted major enterprises through comprehensive infrastructure and tax relief measures. The city also unveiled plans for a new “FinTech and AI City,” underscoring its growing capacity in the digital economy and high-tech innovation.

The AIFC Almaty Office elaborated on the city’s unique position as a Eurasian financial hub, with an independent judicial and arbitration system, zero corporate income tax, and zero VAT. Hosting over 4,500 registered participants, AIFC’s exchange offers diversified financial instruments—including equity, bonds, and green finance—enabling global-standard services for regional enterprises.

Atameken, as a bridge between business and government, detailed its support for entrepreneurs through free legal, accounting, and marketing consultations, as well as trade fairs and networking platforms to connect local and international enterprises. Its nationwide network of branches and bilateral business councils provides strong institutional protection for both domestic and foreign investors.

Freedom Holding CTO Renat Tukanov also shared insights from a market participant’s perspective, highlighting the vitality and investment potential of Kazakhstan’s FinTech ecosystem.

Photo: Institutional visit and exchange session

Industry and Enterprise Case Studies

Beyond institutional exchanges, students conducted on-site visits to leading enterprises across multiple sectors, gaining firsthand insights into local industrial dynamics and Sino-Kazakh cooperation outcomes.

At Transport Holding of Almaty, students engaged with the ONAY mobile application team, which operates Kazakhstan’s largest FinTech and mobility platform. The team detailed its evolution from transportation services to integrated financial solutions, offering valuable lessons on localized user operations and technology adaptation for FinTech ventures entering Central Asia.

Photo: Visit to ONAY headquarters

At Kaspi Bank, a regional FinTech leader, representatives introduced the company’s SuperApp ecosystem. Students explored its “single-entry, multi-service integration” model—expanding from core financial and payment services into e-commerce and logistics. With the highest download and engagement rates in Central Asia, Kaspi’s “technology-driven efficiency and ecosystem expansion” strategy provided a powerful benchmark for studying cross-border FinTech development.

Photo: Visit to Kaspi headquarters

During the visit to the Yutong Bus Kazakhstan Plant, students observed a prime example of Sino-Kazakh industrial cooperation. Executives explained how the plant has localized production, expanded the supply chain, and created substantial local employment. The factory’s new-energy bus models, designed for Central Asian climates and supported by localized service systems, exemplified how Chinese enterprises successfully combine “technology export with local operations” to achieve sustainable industrial partnerships.

Students also met with representatives from Verny Kapital Group and Forte Bank. Daniyar Tursunkulov, Deputy CEO and CFO of Verny Kapital, shared his insights on capital management, financial innovation, and cross-border risk control. His analysis of Kazakhstan’s financial sector development and its implications for China–Kazakhstan cooperation offered students a valuable perspective on cross-border finance.

Photo: Daniyar Tursunkulov speaking with students

Internal Sharing Session:

Cross-Border Wisdom and Insight

Continuing the “Bring Your Insights” series, the Almaty module featured a themed internal session titled “20 Years in Central Asia: Experience, Insight, and the Future.” Moderated by Crystal He, CEO of DL Family Office, the session invited several BRI EMBA students and alumni deeply engaged in Central Asia to share their reflections.

Daniiar Isakov, CEO and Board Member of Kara-Balta Mining, shared: “In Central Asia, patience is the foundation, and localization is the key. Over ten years, we evolved from raw resource extraction to deep processing, fully integrating with local communities and nurturing local management talent—this is what ensures long-term return.”

Hao Chen, former Vice President of CITIC NIYA, added: “Cross-border collaboration requires long-termism. Respect for local culture and legal systems must go hand in hand with the export of technology and standards to build trust. CITIC’s projects in Turkmenistan and Uzbekistan demonstrate how the ‘Chinese standard + local operation’ model achieves both commercial and social value.”

Nurtas Janibekov, Advisor to the Almaty Special Economic Zone, emphasized: “The greatest non-financial contribution foreign enterprises can make to Central Asia is the spillover of knowledge and standards. In metallurgy, for instance, Chinese enterprises bring not just capital but advanced technology, environmental standards, and management systems—catalyzing the region’s industrial upgrading.”

Yanan Wu, Chairman and CEO of Surfin Meta Digital Technologies and Meta Fund Investment Management, focused on the digital economy: “Central Asia’s FinTech and cross-border e-commerce sectors are on the brink of explosive growth. The success of Kaspi Bank’s SuperApp has validated the model; over the next five years, blockchain-based cross-border payments and social e-commerce targeting the Central Asian market will present compelling opportunities.”

This session broke traditional classroom boundaries, fostering a cross-sectoral exchange of ideas and experiences among peers from mining, finance, energy, and investment backgrounds—cultivating a collaborative learning ecosystem rooted in shared insight and resource exchange.

Photo: “Bring Your Insights” internal sharing session

Program Impact:

Linking Central Asia, Shaping a New Model of Cross-Border Cooperation

The five-day Almaty module exemplified the Tsinghua PBCSF BRI EMBA Program’s educational philosophy of “Global Vision with Local Practice.” From macro-level academic perspectives to sector-specific insights and peer exchanges, the program offered students a comprehensive framework for understanding and engaging with Central Asia.

Students noted that beyond recognizing the region’s vast potential, the module’s site visits and discussions clarified practical pathways for collaboration. Looking ahead, they expressed the desire to apply these insights in fields such as mining investment, financial technology, and cross-border energy cooperation—using finance as a bridge to contribute to the high-quality development of the Belt and Road Initiative across Central Asia.