On September 29, 2020, students from the Belt & Road Initiative (BRI) Executive MBA Program joined in remotely for a virtual forum on Central Asian financial mechanisms and investment opportunities with top Central Asian government officials and business leaders. Kan Cai, Associate Director of the Center for Finance EMBA at Tsinghua PBCSF, opened the forum. Nurtas Janibekov, student of the Tsinghua PBCSF BRI EMBA Program and Adviser to the Governor of Astana International Financial Centre (AIFC), hosted the session.

Central Asia, broadly defined as the region east of the Caspian Sea comprising Uzbekistan, Kazakhstan, Tajikistan, Kyrgyzstan and Turkmenistan, is an upcoming economic region and attractive investment destination. Yet, it is not very well known to the rest of the world, mostly due to historical and geographical reasons. With the post-pandemic investment landscape continuing to adapt to the new market environment, the Central Asian region is gradually becoming a more rational bet.

Co-organized by the Center for Finance EMBA of Tsinghua PBCSF and AIFC, this online interactive dialogue with Central Asian experts provided students of the BRI EMBA Program a chance to discover the local financial mechanisms of Central Asia and tap into new investment opportunities amid the challenges from the COVID-19 pandemic.

Yernur Rysmagambetov, CEO of AIFC Authority, Asel Zhanassova, Vice Minister of Trade and Integration of the Republic of Kazakhstan, Nazira Beishenalieva, Chairperson of the Board of Directors of CJSC Bank of Asia and a participant of the South-South Program for Economics and Finance of Tsinghua University PBCSF, Abdullo Kurbanov, Co-founder and CEO of Alif Bank, as well as Zuhursho Rahmatulloev, Co-founder of Alif Bank (Tajikistan) and CEO of Alif Moliya (Uzbekistan), each delivered a brief presentation on their respective region and country before coming together for a panel discussion.

AIFC: An Emblem of Kazakhstan’s 100 Concrete Steps

Five years ago, Kazakhstani President Nursultan Nazarbayev set out 100 concrete steps to implement the five institutional reforms encompassing the creation of a modem and professional civil service, enforcement of the rule of law, industrialization and economic growth, a unified nation for the future, and transparency and accountability of the state. One of these steps was the founding of AIFC, which is a separate and independent jurisdiction within Kazakhstan established based on the English common law in order to foster a better business environment for investments, financial markets, and capital markets.

Yernur Rysmagambetov is CEO of AIFC Authority, where he heads business development, educational programs and human resource management. Having studied at LSE and Caltech, where he was classmates with Elon Musk, Rysmagambetov worked in various financial firms, including JP Morgan Chase investment banking and Wilshire Associates, Inc. He had worked in the private sector for six years before switching lanes to public investment management six years ago.

“AIFC plays a pivotal role in positioning itself as a global centre for business and finance,” Rysmagambetov introduced, “connecting the economies of the Central Asia, the Caucasus, EAEU, West China, Mongolia, Middle East and Europe.” The organization has four strategic directions - attracting investment into the economy; developing a securities market and integrating it with other international capital markets; developing insurance markets, banking services, Islamic Finance, financial technologies, electronic commerce; and developing financial and professional services based on the best practices around the globe.

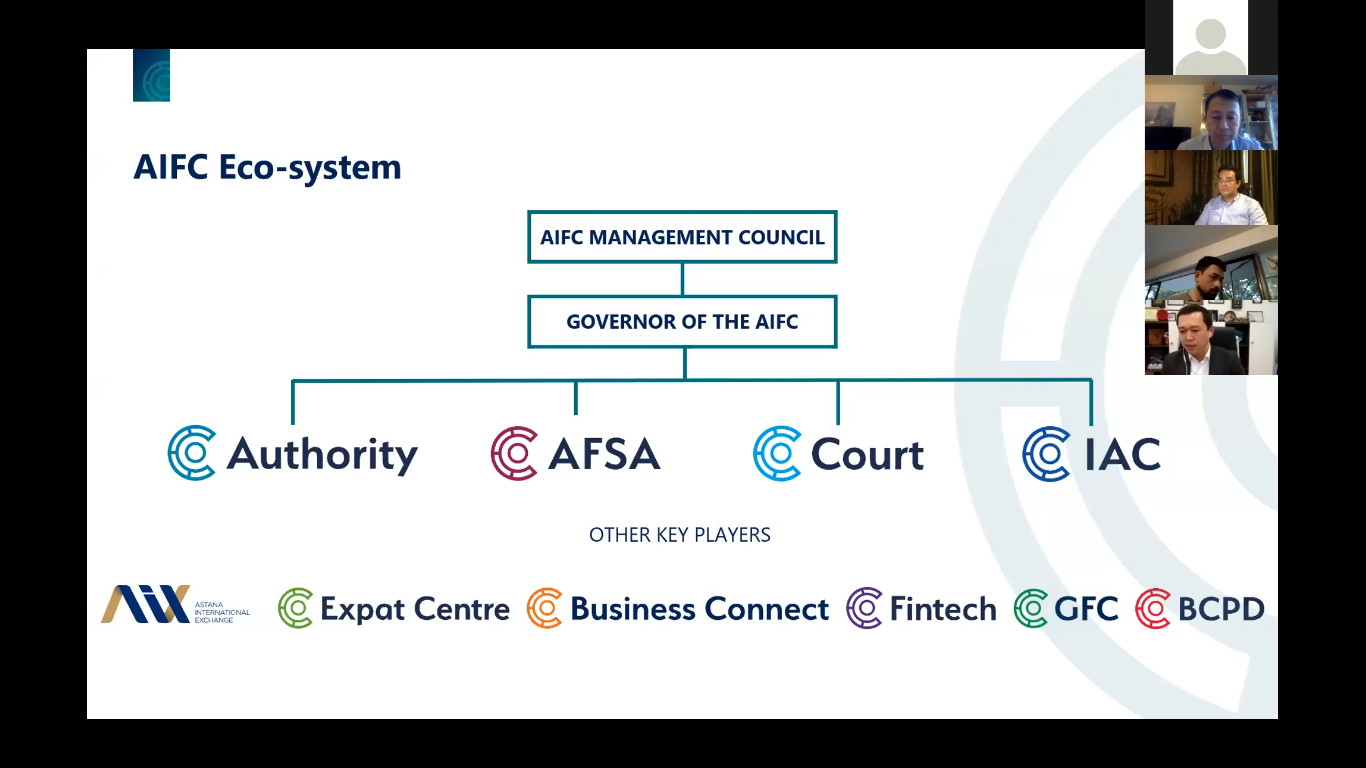

The Governance Structure of AIFC

AIFC also has a multifunctional area for the global community of investors. Over the years, AIFC has formed strategic partnerships with the world’s leading stock exchanges and financial institutions, comprising Nasdaq, Silk Road Fund, Goldman Sachs, and Shanghai Stock Exchange, all of which help increase liquidity in the capital market, as well as provide a modern trading platform for the AIFC exchange.

Through an English Common Law jurisdiction, world-class regulation standards, full tax exemption until 2066, special labor and visa regimes, and a developed financial and business ecosystem, AIFC creates a favorable business environment that serves as the financial gates to regional economies, the Belt and Road Initiative, and the privatization of state enterprises. So far, as many as 563 companies from 45 countries have registered as AIFC participants.

AIFC Participants around the Globe

Invest Kyrgyzstan: A Closer Look at the Country’s Business Opportunities

Two years ago, Beishenalieva had a chance to study at Tsinghua University PBC School of Finance, where she participated in the South-South Program for Economics and Finance. Nazira Beishenalieva is the Chairperson of the Board of Directors of CJSC Bank of Asia, a family-owned business, where she oversees the activities of the Board in the formation of bank policy and the execution of bank strategy. She is also the Chairwoman of the Board of Directors of the American Chamber of Commerce in Kyrgyzstan, and a member of the Board of Trustees of the American University of Central Asia.

The Kyrgyz Republic is a landlocked country with a population of 6.2 million. Its service-based economy has remained relatively stable over the years, with GDP sitting at around 8 billion dollars, growing moderately at approximately 3.5% per year. Breaking down the GDP, Beishenalieva illustrated that services account for 47% of the entire economy, while industry, agriculture, construction and others account for the rest. The Kumtor gold mine is the Kyrgyz Republic’s largest enterprise, accounting for 8% of the economy alone, said Beishenalieva.

Looking at Kyrgyzstan’s FDI inflow by sector, Beishenalieva pointed out that manufacturing, science and technology, and finance rank as the top areas attracting foreign direct investments. The largest foreign direct investor is China, followed by Canada, Russia, Great Britain, Kazakhstan, Turkey, and Germany. Beishenalieva also discussed trade indicators for the country. Around 40% of Kyrgyzstan imports come from China. “In 1996, Kyrgyzstan entered the WTO,” she noted, “and this has unlocked the country’s export potential.” Since then, the Republic imported raw material from China, produced machinery and equipment, then exported them to other countries in the world. “This played an important role in the economy, contributed to the growth of jobs, generated surplus value, and ensured the inflow of foreign currency into the country,” Beishenalieva commented.

Central Asia Region Overview

International Cooperation of the Kyrgyz Republic

Beishenalieva highlighted Kyrgyzstan’s high technology park, which is special tax zones that cover the whole country aimed at supporting software development, computer science and education, as well as export of IT services. Within these special tax zones, there is 0% profit tax, sales tax, and VAT, with only 5% applicable income tax. “High technology park is now a very attractive investment destination,” Beishenalieva said.

Kyrgyzstan is also trying to redirect its economy from being re-export-oriented to export-oriented, focusing on locally producing more goods in order to improve the overall economic structure. Priority sectors of the economy now include agriculture, manufacturing, energy, tourism, information technology, and mining.

In addition, Beishenalieva spoke about the main challenges and risks for doing business in Kyrgyzstan. These include low market dynamics, weak rule of law, inadequate access to finance, insufficient level of transit of the transport and logistics network, inter-ethnic rifts, as well as social tension.

However, despite these concerns, Beishenalieva believes that Kyrgyzstan possesses great potential for investors. With only 12% VAT, 10% incomes tax, and 10% profit tax, it takes only 3 days to register a new business in this country where 1 KWH of electricity costs only $0.03, the cheapest in the world.

Having lived in a few other countries before coming back to her home country, Beishenalieva said Kyrgyzstan presents a lot of investment opportunities and new market niches in the development of private equity funds, mezzanine lending, and venture capital financing mechanism. Other areas such as the insurance market, stock market, leasing of agricultural machinery, fintech and innovation, as well as the development of large commodity and logistic centers are offering rewarding opportunities for investors.

Kazakhstan: Why It Stands Out From the Rest

Asel Zhanassova is Vice Minister of Trade and Integration of the Republic of Kazakhstan. In the last 10 years, she had many important work assignments in both international and Kazakhstani settings before becoming Advisor to the Manager of the Astana International Financial Center. From 2018, she has also been Chief Digital Officer at the Astana International Financial Center.

Since Kazakhstan became independent in 1991, the country’s economy has grown substantially. “Indeed we have much to be proud about,” said Zhanassova, “with our nation’s GDP increasing 16-fold after independence, and our ability to grow at a constant healthy rate is undisputed.”

When it comes to attracting and encouraging FDIs, the country’s record is also strong. A key factor throughout Kazakhstan’s economic development has been its ability to attract high level of foreign direct investments, which are now approaching 300 billion US dollars. “In an increasingly competitive world, where most of the countries are doing their utmost to attract high quality inward investments, it’s important that Kazakhstan can differentiate itself from others and have a clear offer about its advantages and benefits to investors,” Zhanassova said.

Kazakhstan is generally stable politically, socially, and economically. The country also enjoys good relations with all its neighbors, including Russia, China, EU, and the US. Economically, the country has seen tremendous development since independence, and is now the largest economy in Central Asia. Moreover, Kazakhstan has abundant natural resources, especially mineral elements. “99 out of the 110 elements on the periodic table can be found in Kazakhstan,” Zhanassova noted, “and 90% of the rare earth metals found in a modern smart home can be mined in Kazakhstan.”

The World Bank also estimates that there are over 5,000 unexplored deposits in Kazakhstan, valued at over 46 trillion US dollars. Advanced technologies are central to the modern world. High frequency lasers, X-ray machinery, smart technologies, electric vehicles, and advanced robotics are all heavily dependent on rare earth metals, which can be extracted within Kazakhstan. The country thus has unique potential in the exploration, development, and processing of rare earth metals.

Being one of only a handful of countries globally with the perfect conditions for growing wheat and grain without the need for artificial irrigation, Kazakhstan also prioritizes its agricultural sector. The country produces high-quality and organic beef and dairy, which come from grass-fed diets all year-round. According to Zhanassova, roughly 1/5 of Kazakhstan’s working population is employed in the agricultural sector. Cheap labor costs and vast size of its land indicate that the country has plenty of room for more growth and investment in this sphere.

Kazakhstan’s location at the crossroads of Europe and Asia provides benefits such as export potential. It can work as a transit country for businesses in trade. Over the years, Kazakhstan has transformed into a modern transit hub, and has been described as the “Buckle of the Belt”, and as part of the New Silk Road. Around 70% of the traffic between China and Europe pass through the country. Today, the speed of container trains has reached 1,100 km per day, meaning that it would take maximum 15 days to deliver a cargo from a Southeast province in China to Europe.

Kazakhstan’s business environment has also improved greatly. According to the 2019 World Bank Doing Business Index, Kazakhstan climbed 8 places and is now sitting at 28th worldwide. Today, people can register online for a new business through AIFC in as little as 15 minutes.

With respect to Kazakhstan’s workforce, Zhanassova said that the country is rich in young and talented people. On top of that, Kazakhstan has a high literacy rate with most people being bilingual.

In terms of infrastructure, Kazakhstan has an extensive 4G network which is available throughout the country. According to Zhanassova, 14 million Kazakhs regularly use the internet, with a high penetration rate of about 77%. Additionally there are currently 12 special zones and 22 industrial zones in Kazakhstan, which offer investors 0% rate for corporate income tax, land tax, property tax, custom duty extensions as well as simplified employment procedures for foreign labors.

Alif Bank: Revolutionizing Tajikistan’s Banking and Finance

Abdullo Kurbanov is Co-founder and CEO of Alif Bank. Previously, he served as Deputy Chairman of the Board of Orienbank, one of the largest commercial banks in Tajikistan. Kurbanov also worked in Mining Investments in Mongolia and China and held positions in London for UBS Investment Bank, a Swiss global investment bank. He also worked for Oliver Wyman (Financial Consulting) out of London and Moscow.

In 2014, Kurbanov founded Alif Bank with a couple of friends to provide technologically-driven credit and payment services. Today, Alif has over 400 employees, and over 300,000 users, while being profitable every year. “We are well on our way to make just around 150 million US dollars by 2024,” Kurbanov mentioned.

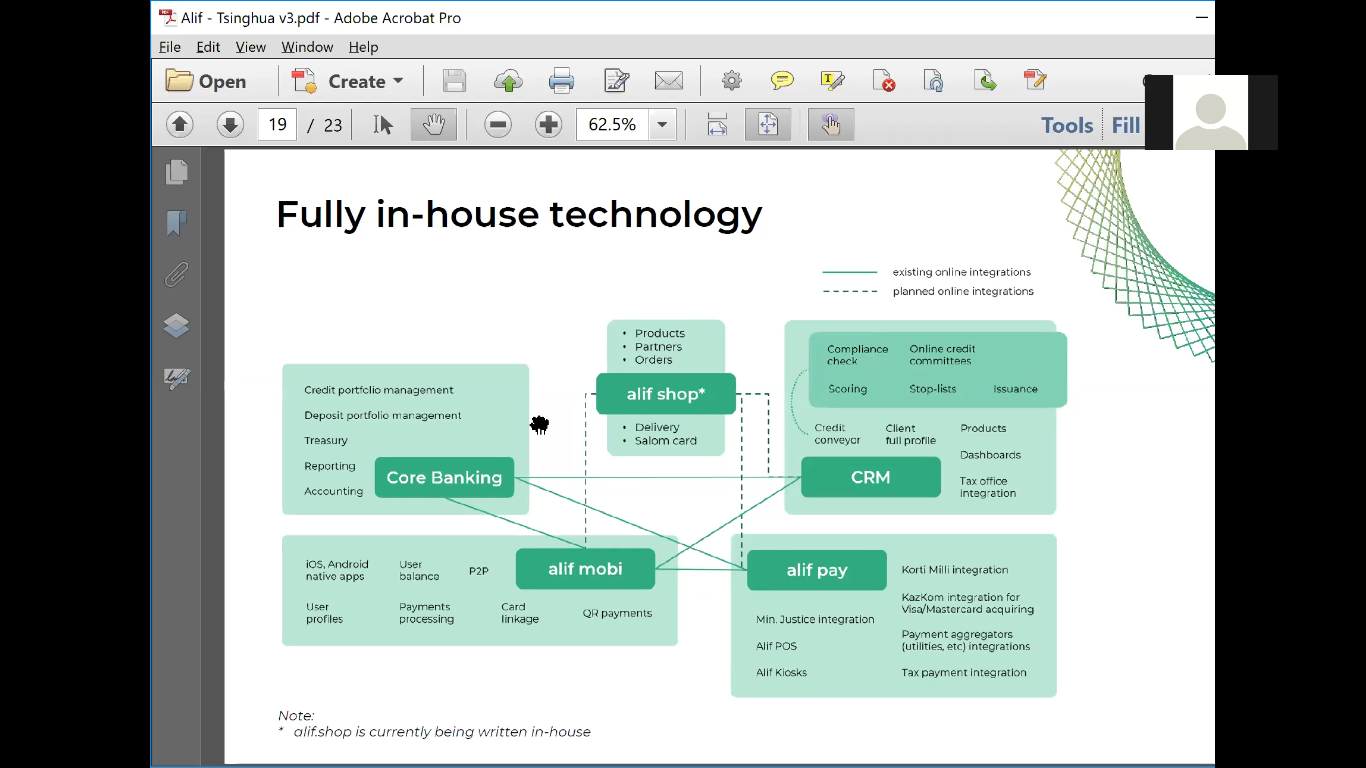

Alif Bank Builds Its Own Technology

Kurbanov saw an opportunity when he noticed that the average monthly salary in Tajikstan was $140 while the cheapest washing machine was $200. In order to solve the problem of affordability, Alif Bank established partnerships with over 1,000 merchants to introduce interest-free, commission-free credit whereby a family could get a washing machine now and pay 10 installments at 20 dollars each. Alif Bank earns a commission from the merchant, as it helps grow their sales. This has helped increasing customer retention and “negative churn”. By using simple QR POS technology, clients pay with pre-approved credit by scanning the QR code.

Alif’s market share in POS/online financing in Tajikistan has grown more than 70%. “As the fintech ecosystem keeps growing and financial inclusion and Shariah compliance become normalized, this will unlock huge potential for the sector, “ Kurbanov pointed out. Being the number one finance app in the country, Alif Bank is trying to solve a huge problem. In the $1.3 billion plastic cards user spending, only 6% account for non-cash, so Alif is working on the 94%.

Alif Bank’s Recent Collaborations with VISA, IFC, MFR

Kurbanov also discussed one of the other areas that Alif is working on. Millions of migrants from central Asian countries are working in Russia and sending around $10 billion dollars a year to their families. This process is time-consuming and almost all is in cash. “This payment can also be digitalized,” Kurbanov said. Alif has already made a soft launch in Russia, already acquiring 25,000 users. Alif aims to grow the remittance sector to make it more efficient in the future.

Uzbekistan: Tech Advancing Rapidly as Reforms Allow More Freedom

Zuhursho Rahmatulloev is Co-Founder of Alif Bank in Tajikistan and a fin-tech company in Uzbekistan. Prior to founding Alif, Rahmatulloev served as Business Development Manager at one of the leading audit firms in the country. In addition, he co-founded a Public Organization, “Peshraft,” which supports young leaders through various stipend programs as well as different social initiatives.

The idea behind Alif Tech was to build a tech infrastructure or an ecosystem that would allow various merchants and retail stores to sell their products with installment payments. Within the last twelve months, Alif has attracted investments through a revenue sharing model of over 5 million dollars, and the company has another 4 million dollars in commitments to be placed by the end of this year.

According to Rahmatulloev, Alif’s current investors acquire around 12% per annum based on the revenue sharing model, where income is tied to the performance of Alif’s credit portfolio. In July 22, Alif received its license from the central bank of Uzbekistan to operate as a payment system in the country. Being the first foreign company to have this license, Alif can now launch its own electronic wallets within Uzbekistan. The wallet has a strong position in Tajikistan, and Alif plans to emulate this success in Uzbekistan and beyond.

Rahmatulloev mentioned that Uzbekistan was chosen by economists as the nation that improved the most in 2019. He said that Uzbekistan embarked on the path of reforms and liberalization of its economy relatively recently. Over the past twenty years, before the new president took post, Uzbekistan’s central bank had been conservative and overregulated. Some changes are taking place now. “Given the current state of affairs, redirecting resources to retail may take time, and it is something new that needs to be explored,” Rahmatulloev said.

The virtual sharing sessions of the BRI EMBA Program will continue to be a place for students to share ideas during this special time. With almost 70% of the students enrolled in the Program based overseas, remote learning and online class meetings have benefited students in terms of time and location flexibility. The Center of Finance EMBA has also been organizing a number of other online exchanges for students of the Chinese EMBA Program.

Since its inception in May 2017, the BRI EMBA Program has attracted more than 180 high-level enterprise decision-makers from 22 countries and regions, including Singapore, Indonesia, Malaysia, Thailand, the United States, Canada, Kyrgyzstan, Kazakhstan. A number of students from Southeast Asian Countries hold Tan Sri, Dato' Sri, Dato’, Tengku and other honorary titles. Nearly 40% of the students graduated from world-renowned universities such as MIT, Stanford, Harvard, Yale, Cornell, Oxford, Cambridge and Imperial College London.